|

People, Profits, & Pensions |

|

Who are the New Capitalists?

Thursday, March 13, 2014

By and large, they’re the middle class, people who are neither very rich nor very poor. I call them working people because they get all or most of their income from working, rather than from invested capital. And, quite frankly, I call them working people because of the ironic fact that capitalism, not socialism, made them the owners of what socialists call the ‘means of production.’ By the way, I’m one of them, too! But, let’s focus on their need to work. As noted, they can’t afford to stay home and live off their accumulated savings. At the same time, they do have enough money to invest in a more comfortable retirement, and most expect – or hope – to live as comfortably in retirement as they do while working. Within that group of working people we see everyone from daycare workers to doctors. Some might consider doctors and other professionals to be rich, rather than working people. However, that doesn’t account for the time and money they invested in their careers, nor the obligations that go with those positions. So, while they might earn enviable annual incomes, their hourly incomes or net incomes might be much less. The middle class, then, takes in most of the adult population of working age in the developed nations. The question of “Who?” was also captured by President Paul Schott Stevens of the Investment Company Institute, who told the 2005 Mutual Funds and Investment Management Conference, “After centuries of being an elite privilege, investing has grown to become a mass opportunity. America has taken an extraordinary leap forward in creating an “Ownership Society.” “Mutual funds are one of the principal reasons. The share of [American] households with fund investments has shot up from 5 to 50 percent in just a generation, since 1978. The assets mutual funds manage have swelled from $56 billion to over $8 trillion.” What makes this story even more interesting is the emergence of a middle class in so many developing countries. From South America to Asia and the former Soviet Bloc, literally billions of citizens are emerging from poverty and moving into the middle class. For more connections between working, middle class people and the world's biggest corporations, please visit our archives. The Bigger Picture:Will Profits from Big Macs Add to Your Retirement Income?In 1948, the McDonald brothers redesigned and remodelled their drive-in restaurant in San Bernardino, California. Taking inspiration from Henry Ford's assembly-line, they created the fast food revolution, with the quick service and low prices we now take for granted. In that same year, the U.S. National Labor Relations Board ruled unions could include pension issues in contract negotiations. That ignited a massive expansion of pension plans. In the 1950s, pension funds started buying stocks, rather than just bonds or their equivalents; in addition mutual funds came of age. With these two developments working, middle class people became owners of big business. At first, their stakes were modest, but steadily growing. And in just a few decades, they gained controlling interests in many large corporations through their funds. Management guru Peter Drucker has called it, "...one of the most startling power shifts in economic history." Now, working people reap the benefits of those investments, collecting much of the profit distributed by McDonald's and other big corporations. Discover how the pieces fit together. In Big Macs & Our Pensions: Who Gets McDonald's Profits? - a new booklet -(about 25-pages), you will:

You may not be among the owners of McDonald's. But if you belong to any pension plan, or contribute to a mutual fund or whole life insurance policy, you likely own pieces of some big corporations. More importantly, though, your retirement income will be bigger and grow more dependably than you would otherwise expect. Big Macs & Our Pensions: Who Gets McDonald's Profits? is now available at Amazon.com |

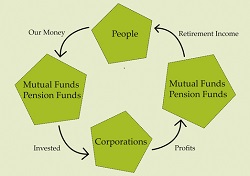

The Ownership Cycle

Copyright 2014. Robert F. Abbott, All Rights

Reserved.

|

Background, by Robert F. Abbott, author of

Background, by Robert F. Abbott, author of  So, who are these middle class, working people I’ve referred to so often in these blog posts?

So, who are these middle class, working people I’ve referred to so often in these blog posts?