|

People, Profits, & Pensions |

|

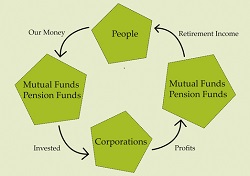

TIAA-CREF Contributors and Chubb Sunday, March 30, 2014 I And, if your do contribute to through TIAA-CREFF, you would have been among the owners of just over 1-million shares of Chubb, the big insurance company, at the end of 2013 (based on figures from nasdaq.com). At that time, those shares had a value of $88,915,000.00 The Chubb Corp., (ticker CB) enjoys widespread ownership among institutional investors, more than 85% of its stock. Institutional investors refers to collective investing organizations, the biggest of which are pension funds, mutual funds, and insurance companies. The ranks of institutional investors also includes hedge funds and college endowment funds. If you'd like to know more about Chubb, please see the investment profile I published last week at Seeking Alpha. It's titled, Chubb's Business Model & Execution: A Platform for Income. For more connections between working, middle class people and the world's biggest corporations, please visit our archives. The Bigger Picture:Will Profits from Big Macs Add to Your Retirement Income?In 1948, the McDonald brothers redesigned and remodelled their drive-in restaurant in San Bernardino, California. Taking inspiration from Henry Ford's assembly-line, they created the fast food revolution, with the quick service and low prices we now take for granted. In that same year, the U.S. National Labor Relations Board ruled unions could include pension issues in contract negotiations. That ignited a massive expansion of pension plans. In the 1950s, pension funds started buying stocks, rather than just bonds or their equivalents; in addition mutual funds came of age. With these two developments working, middle class people became owners of big business. At first, their stakes were modest, but steadily growing. And in just a few decades, they gained controlling interests in many large corporations through their funds. Management guru Peter Drucker has called it, "...one of the most startling power shifts in economic history." Now, working people reap the benefits of those investments, collecting much of the profit distributed by McDonald's and other big corporations. Discover how the pieces fit together. In Big Macs & Our Pensions: Who Gets McDonald's Profits? - a new booklet -(about 25-pages), you will:

You may not be among the owners of McDonald's. But if you belong to any pension plan, or contribute to a mutual fund or whole life insurance policy, you likely own pieces of some big corporations. More importantly, though, your retirement income will be bigger and grow more dependably than you would otherwise expect. Big Macs & Our Pensions: Who Gets McDonald's Profits? is now available at Amazon.com |

The Ownership Cycle

Copyright 2014. Robert F. Abbott, All Rights

Reserved.

|

By Robert F. Abbott, author of

By Robert F. Abbott, author of  f you teach, work at a university, or a non-profit organization, you may make

retirement contributions through

f you teach, work at a university, or a non-profit organization, you may make

retirement contributions through