|

People, Profits, & Pensions |

|

Ohio Teachers & SeaWorldBy Robert F. Abbott, author of Big Macs & Our Pensions: Who Gets McDonald's Profits? the book that explains the connection between the retirement income of the middle class and the profits of big business Friday, March 14, 2014

Here's how the CEO summed up the results for the year, in a press release,

State Teachers Retirement System of Ohio owned just under 133,000 shares of SeaWorld Entertainment on December 31st, according to nasdaq.com. The pension fund describes itself this way on its website,

The Company reported full year net income for 2013 of $50.5 million, or $0.57 per diluted share. Adjusted Net Income[1] was $101.4 million, or $1.15 per diluted share. In the prior year,

the Company generated net income of $77.4 million, or $0.93 per diluted share. - See more at:

http://seaworldinvestors.com/news-releases/news-release-details/2014/SeaWorld-Entertainment-Inc-Reports-Record-Full-Year-2013-Results/default.aspx#sthash.gviadoeO.dpuf

The Company reported full year net income for 2013 of $50.5 million, or $0.57 per diluted share. Adjusted Net Income[1] was $101.4 million, or $1.15 per diluted share. In the prior year,

the Company generated net income of $77.4 million, or $0.93 per diluted share. - See more at:

http://seaworldinvestors.com/news-releases/news-release-details/2014/SeaWorld-Entertainment-Inc-Reports-Record-Full-Year-2013-Results/default.aspx#sthash.gviadoeO.dpuf

The Company reported full year net income for 2013 of $50.5 million, or $0.57 per diluted share. Adjusted Net Income[1] was $101.4 million, or $1.15 per diluted share. In the prior year,

the Company generated net income of $77.4 million, or $0.93 per diluted share. - See more at:

http://seaworldinvestors.com/news-releases/news-release-details/2014/SeaWorld-Entertainment-Inc-Reports-Record-Full-Year-2013-Results/default.aspx#sthash.gviadoeO.dpuf

For more connections between working, middle class people and the world's biggest corporations, please visit our archives. The Bigger Picture:Will Profits from Big Macs Add to Your Retirement Income?In 1948, the McDonald brothers redesigned and remodelled their drive-in restaurant in San Bernardino, California. Taking inspiration from Henry Ford's assembly-line, they created the fast food revolution, with the quick service and low prices we now take for granted. In that same year, the U.S. National Labor Relations Board ruled unions could include pension issues in contract negotiations. That ignited a massive expansion of pension plans. In the 1950s, pension funds started buying stocks, rather than just bonds or their equivalents; in addition mutual funds came of age. With these two developments working, middle class people became owners of big business. At first, their stakes were modest, but steadily growing. And in just a few decades, they gained controlling interests in many large corporations through their funds. Management guru Peter Drucker has called it, "...one of the most startling power shifts in economic history." Now, working people reap the benefits of those investments, collecting much of the profit distributed by McDonald's and other big corporations. Discover how the pieces fit together. In Big Macs & Our Pensions: Who Gets McDonald's Profits? - a new booklet -(about 25-pages), you will:

You may not be among the owners of McDonald's. But if you belong to any pension plan, or contribute to a mutual fund or whole life insurance policy, you likely own pieces of some big corporations. More importantly, though, your retirement income will be bigger and grow more dependably than you would otherwise expect. Big Macs & Our Pensions: Who Gets McDonald's Profits? is now available at Amazon.com |

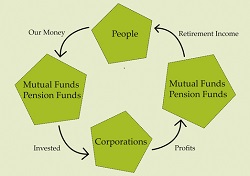

The Ownership Cycle

Copyright 2014. Robert F. Abbott, All Rights

Reserved.

|

Ohio may not be near any salt-water seas, but its teachers are big owners of SeaWorld

Entertainment, the theme park company. So, when SeaWorld (SEAS) announced its fourth quarter and full year

2013 results yesterday, teachers would have been interested.

Ohio may not be near any salt-water seas, but its teachers are big owners of SeaWorld

Entertainment, the theme park company. So, when SeaWorld (SEAS) announced its fourth quarter and full year

2013 results yesterday, teachers would have been interested.