|

People, Profits, & Pensions |

|

Norwegians & Tupperware: The Stock Ownership Story

Monday, March 17, 2014

Tupperware, like most major corporations, sells its goods around the world. And like most big companies, it is owned by working, middle class people around the world. That's no coincidence: As pension funds grow more sophisticated, they look for opportunities to invest in other countries. Globalized investing for retirement income has at least two beneficial effects. One is to earn higher returns, and the second is to enjoy greater safety than investing in the home country alone. Hence, Norwegians invest in American companies, and in companies in many other countries as well. At the same time, Americans invest in Norwegian companies, as well as companies in other countries. Norway has one of the world's largest funds, a combination of sovereign wealth fund and pension fund. When the country's oil industry began gushing great profits a few decades ago, the country decided to put away some of the profits. The immediate plan was to save for the rainy day that would come when oil royalties began to slow down or stop. In addition, Norwegians recognized they had an ageing population, and a need to save for a wave of spending on pensions. So they began saving in a disciplined way, and now have one of the world's largest funds. According to nasdaq.com, the fund, managed by Norges Bank (Norway's Central Bank), owned more than $163 billion worth of stock in 1,994 companies listed on American stock markets. Through the Norges Bank, Norwegians owned 436,405 shares of Tupperware, worth $35 and half million, at the close of trading on December 31st, 2013. The company has some 50 million shares outstanding, and 93.5% of those shares are owned by institutional investors (mainly pension funds, mutual funds, and insurance companies). As mentioned above, Tupperware went ex-div this morning, meaning that anyone or any fund that owned shares prior to today would receive the first quarter dividend of 68 cents. For Norwegians, this means they'll receive $296,755 in cash within the next few weeks (assuming they still own the same number of shares). Unfortunately, we don't expect the Norges Bank to store any of that cash in Tupperware containers! For more connections between working, middle class people and the world's biggest corporations, please visit our archives. The Bigger Picture:Will Profits from Big Macs Add to Your Retirement Income?In 1948, the McDonald brothers redesigned and remodelled their drive-in restaurant in San Bernardino, California. Taking inspiration from Henry Ford's assembly-line, they created the fast food revolution, with the quick service and low prices we now take for granted. In that same year, the U.S. National Labor Relations Board ruled unions could include pension issues in contract negotiations. That ignited a massive expansion of pension plans. In the 1950s, pension funds started buying stocks, rather than just bonds or their equivalents; in addition mutual funds came of age. With these two developments working, middle class people became owners of big business. At first, their stakes were modest, but steadily growing. And in just a few decades, they gained controlling interests in many large corporations through their funds. Management guru Peter Drucker has called it, "...one of the most startling power shifts in economic history." Now, working people reap the benefits of those investments, collecting much of the profit distributed by McDonald's and other big corporations. Discover how the pieces fit together. In Big Macs & Our Pensions: Who Gets McDonald's Profits? - a new booklet -(about 25-pages), you will:

You may not be among the owners of McDonald's. But if you belong to any pension plan, or contribute to a mutual fund or whole life insurance policy, you likely own pieces of some big corporations. More importantly, though, your retirement income will be bigger and grow more dependably than you would otherwise expect. Big Macs & Our Pensions: Who Gets McDonald's Profits? is now available at Amazon.com

|

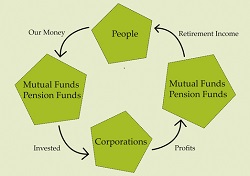

The Ownership Cycle

Copyright 2014. Robert F. Abbott, All Rights

Reserved.

|

By Robert F. Abbott, author of

By Robert F. Abbott, author of  On this day, Tupperware's first ex-dividend day of 2014, let's consider globalization of

retirement funds. More specifically, let's discuss how all Norwegians, through their government-sponsored

pension fund, are significant owners of Tupperware, the company that makes those ubiquitous plastic

containers.

On this day, Tupperware's first ex-dividend day of 2014, let's consider globalization of

retirement funds. More specifically, let's discuss how all Norwegians, through their government-sponsored

pension fund, are significant owners of Tupperware, the company that makes those ubiquitous plastic

containers.