|

People, Profits, & Pensions |

|

California Public Employees & Books-A-Million, Inc.

Friday, March 21, 2014

Books-A-Million, Inc. (BAMM) reported its fourth quarter and full year results (ending February 1, 2014). And they disappointed, with revenue, comparable store sales, and net income down. Still, in a press release, CEO Terrance G. Finley said,

Like other bricks and mortar bookstores, BAMM, or BAM! as it refers to itself, now sells online, and it sells a broader product line. Toys, tech stuff, and more have joined books at the checkouts. As of last December 31st, less than 11% of Books-A-Million's shares were owned by institutional investors (pension funds, mutual funds, and insurance companies). And among the remaining pension funds, we see the California Public Employees' Retirement System (CalPERS) with 11,600 shares, valued between $26 and $27 thousand dollars. That holding is down from the same date in 2011, when CalPERS owned 19,500 shares (data from a filing with the SEC). I expect that one reason BAMM has such a low level of institutional holdings has to do with the fact many pension and mutual funds won't buy stock with a valuation of less than $5 or $10. And no doubt it has much to do with the stock price being stuck between $2 and $3 for the past couple of years; it had reached nearly $25 before 2008 struck, and about $15 when the stock market rebounded in 2009.

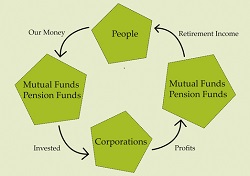

For more connections between working, middle class people and the world's biggest corporations, please visit our archives. The Bigger Picture:Will Profits from Big Macs Add to Your Retirement Income?In 1948, the McDonald brothers redesigned and remodelled their drive-in restaurant in San Bernardino, California. Taking inspiration from Henry Ford's assembly-line, they created the fast food revolution, with the quick service and low prices we now take for granted. In that same year, the U.S. National Labor Relations Board ruled unions could include pension issues in contract negotiations. That ignited a massive expansion of pension plans. In the 1950s, pension funds started buying stocks, rather than just bonds or their equivalents; in addition mutual funds came of age. With these two developments working, middle class people became owners of big business. At first, their stakes were modest, but steadily growing. And in just a few decades, they gained controlling interests in many large corporations through their funds. Management guru Peter Drucker has called it, "...one of the most startling power shifts in economic history." Now, working people reap the benefits of those investments, collecting much of the profit distributed by McDonald's and other big corporations. Discover how the pieces fit together. In Big Macs & Our Pensions: Who Gets McDonald's Profits? - a new booklet -(about 25-pages), you will:

You may not be among the owners of McDonald's. But if you belong to any pension plan, or contribute to a mutual fund or whole life insurance policy, you likely own pieces of some big corporations. More importantly, though, your retirement income will be bigger and grow more dependably than you would otherwise expect. Big Macs & Our Pensions: Who Gets McDonald's Profits? is now available at Amazon.com |

The Ownership Cycle

Copyright 2014. Robert F. Abbott, All Rights

Reserved.

|

By Robert F. Abbott, author of

By Robert F. Abbott, author of  It's sad to see any business struggle, and for those among us who love books, we bemoan the tough

times faced by book sellers. I say that even though I've written books that appear only on Amazon; there's

still a place in my heart for all book stores.

It's sad to see any business struggle, and for those among us who love books, we bemoan the tough

times faced by book sellers. I say that even though I've written books that appear only on Amazon; there's

still a place in my heart for all book stores.