|

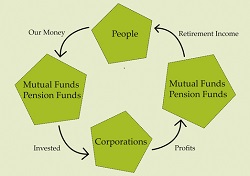

People, Profits, & Pensions |

|

Baby Boomer Retirement: Not So Fast!

Wednesday, March 19, 2014

A number of issues emerge out of this observation. For example, fears that the size of the workforce will abruptly decline as the Boomers retire. Obviously, spreading their retirements over 20 years means gradual, rather than abrupt. In turn, gradual suggests the work done by most Boomer retirees can be replaced at current levels of immigration and new productivity measures. For those still in the workforce, the odds of leveraging a worker shortage into a bigger paycheck just disappeared, as well. Nor should we be overly concerned about the accumulated funds in pension plans being depleted in the next few years. The biggest group of Boomers will remain in the labour force for some years yet, and continue their contributions, giving pension funds and individual retirement plans an opportunity to bulk up, as it were. Again, it’s also worth noting that a rising middle class in the emerging economies will help maintain, if not increase, the demand for stocks and other securities in the years ahead. China, Brazil, India: All will soon boast literally hundreds of millions of new middle class citizens, middle class citizens who will also be investors looking for deals on stocks, bonds, and mutual funds wherever they can find them. Latecomers to the North American retirement party will get their beer and salty snacks after all. That includes Generations X and Y, as well as the Echo Boomers and generations still unborn. And, we can chuckle, as we should, about P.J. O’Rourke’s suggestion that we sell our stocks and buy adult diapers when the Boomers begin to retire. We need not take the suggestion quite so seriously if the Boomers retire over 20 years.

|

The Ownership Cycle

Copyright 2014. Robert F. Abbott, All Rights

Reserved.

|

Commentary, by Robert F. Abbott, author of

Commentary, by Robert F. Abbott, author of  In discussing Baby Boomers, and their retirement, we often refer to them as a monolithic group.

But, as Sherry Cooper points out in her 2008 book, The New Retirement: How It Will Change Our Future, ”While

much was made in the media about the oldest boomers turning 60 in 2006, this group is a relatively small

proportion of the Canadian and U.S. population. Most boomers are in their mid-40s, with another 20 years to go

until retirement…. The boomer retirement wave will not crest until 2025.” (p. 25)

In discussing Baby Boomers, and their retirement, we often refer to them as a monolithic group.

But, as Sherry Cooper points out in her 2008 book, The New Retirement: How It Will Change Our Future, ”While

much was made in the media about the oldest boomers turning 60 in 2006, this group is a relatively small

proportion of the Canadian and U.S. population. Most boomers are in their mid-40s, with another 20 years to go

until retirement…. The boomer retirement wave will not crest until 2025.” (p. 25)