|

People, Profits, & Pensions |

|

Yum! in Arizona

Tuesday, February 4, 2014

Almost 80% of its shares are owned by institutional investors, which means middle class, working people (based on data provided by nasdaq.com). Through their pension funds and mutual funds these people have bought a lot of shares in Yum! and now collect a big part of its earnings. The Arizona State Retirement System (ASRS) owned almost 169,000 shares at the close of trading on September 30, 2013 (nasdaq.com). According to its website, "... the ASRS membership includes the State of Arizona, the three state universities, community college districts, school districts and charter schools, all 15 counties, most cities and towns, and a variety of special districts." The company reported its fourth quarter and full year 2013 highlights yesterday, after the close. Here's how it summed up results for the year in a news release: "Yum! Brands Reports Full-Year EPS Decline of 9%, or $2.97 Per Share, Excluding Special Items; Reaffirms Full-Year Guidance of at least 20% EPS Growth in 2014." Essentially, the company says its net profits (using the term somewhat loosely) fell by 9% when compared to the results for 2012. However, it also reported that it expects those earnings to grow by 20% in the current year, 2014. The decline in earnings is attributed to an avian flu scare in China, but the guidance suggests the company considers that a temporary, one-time issue. In part, that optimism may reflect the opening of 1,940 new restaurants in 2013, including 740 in China. The market apparently expects good things from Yum!; its shares had climbed more than 8% by mid-day today.

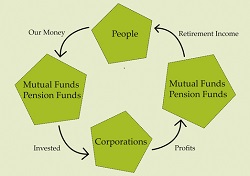

The Bigger Picture:Will Profits from Big Macs Add to Your Retirement Income?In 1948, the McDonald brothers redesigned and remodelled their drive-in restaurant in San Bernardino, California. Taking inspiration from Henry Ford's assembly-line, they created the fast food revolution, with the quick service and low prices we now take for granted. In that same year, the U.S. National Labor Relations Board ruled unions could include pension issues in contract negotiations. That ignited a massive expansion of pension plans. In the 1950s, pension funds started buying stocks, rather than just bonds or their equivalents; in addition mutual funds came of age. With these two developments working, middle class people became owners of big business. At first, their stakes were modest, but steadily growing. And in just a few decades, they gained controlling interests in many large corporations through their funds. Management guru Peter Drucker has called it, "...one of the most startling power shifts in economic history." Now, working people reap the benefits of those investments, collecting much of the profit distributed by McDonald's and other big corporations. Discover how the pieces fit together. In Big Macs & Our Pensions: Who Gets McDonald's Profits? - a new booklet -(about 25-pages), you will:

You may not be among the owners of McDonald's. But if you belong to any pension plan, or contribute to a mutual fund or whole life insurance policy, you likely own pieces of some big corporations. More importantly, though, your retirement income will be bigger and grow more dependably than you would otherwise expect. Big Macs & Our Pensions: Who Gets McDonald's Profits? is now available at Amazon.com

|

The Ownership Cycle

Copyright 2014. Robert F. Abbott, All Rights

Reserved.

|

By: Robert F. Abbott, author of

By: Robert F. Abbott, author of  You may not know the name, but I'm sure you'll know at least one of the tastes. Yum!

Brands, Inc. is the name, it has some 39,000 restaurants, in 125 countries, and was spun off from

PepsiCo in 1997. Most of us know it by the brands it operates or franchises: KFC, Pizza Hut, and Taco

Bell.

You may not know the name, but I'm sure you'll know at least one of the tastes. Yum!

Brands, Inc. is the name, it has some 39,000 restaurants, in 125 countries, and was spun off from

PepsiCo in 1997. Most of us know it by the brands it operates or franchises: KFC, Pizza Hut, and Taco

Bell.